Financial Care with Compassion: Keeping Vulnerable Loved Ones Safe

Helping with Love & Respect

Published: 22 October 2025

Taking care of a loved one’s financial well-being, especially when they’re vulnerable, can be both challenging, and deeply rewarding.

In this post, we’ll explore how to approach financial care with compassion, ensuring their safety and security while maintaining dignity and trust. Are you ready to learn how to protect your loved ones with both heart and wisdom? Let’s get started.

When someone is going through a difficult time — perhaps they’re elderly, unwell, grieving, or just struggling to manage — even simple financial matters can feel overwhelming. Often, you might feel the need to help them. Which is fantastic — however there are also a number of items you need to consider, which will differ, depending on the circumstances. And as I’m sure you’re aware, you will always need to ensure that the help you truly supports their best interests.

I’ve had a lot of experience in this area, both in the helping aspects (there are a number of vulnerable people in our extended family), and working with clients in a corporate finance capacity, as well as in a financial oversight capacity (I worked in financial services – in regulation, in compliance, and in the trenches — for decades). This blog post, while inspired by personal experience, will be kept fairly general in nature — firstly to protect personal privacy (while also incorporating various experiences), but also by being general enough to help more people.

Having said that, it will still share ways you can help protect and support vulnerable people with their finances, while still empowering them to feel safe, respected, and in control. Everybody deserves to feel as empowered and abundant as possible — regardless of their circumstances.

What Does It Mean to Act in Their Best Interest?

Acting in someone’s best interest means making sure any action you take helps them — not you, not anyone else. It’s about helping them with kindness, honesty, and respect. It’s a great test of your own integrity, and has a few cornerstones, such as the ones mentioned below.

Putting their needs, wishes, and wellbeing first.

Being transparent and open about everything you do.

Making sure they understand and agree before decisions are made.

Protecting them from pressure, scams, or anyone who might take advantage

I am aware of one instance where an intellectually disabled person was taken advantage of via a phone call. After the discovery, someone was able to undo the transaction, and told the person involved to hang up if anyone called them that they didn’t know. This has worked well in protecting them from future scams.

Start With Empathy and Respect

Money can be a sensitive topic, especially when someone feels vulnerable. Start every conversation gently. Ask permission before stepping in. Listen to their worries without judgment.

Sometimes, the best help is simply being there — sitting beside them while they go through their bills, or explaining a confusing letter from the bank. I’ve done quite a bit of this over the years. Not everyone understands finances well. Some people feel scared, or threatened by them. Some people don’t want to appear ‘stupid’, so don’t ask questions, and can get themselves into trouble.

Taking the time to explain what things mean, both in a general way (eg. explaining how insurance works), as well as specifically in their particular instance (eg. making an insurance claim), can make a big difference. Or perhaps they have a little money, and don’t know what to do with it — I have personally explained term deposits and various bank accounts, and how they work, to many people. (I use external websites to help me compare products, such as https://www.canstar.com.au/.)

If you are able to explain the financial jargon, in a simple way that they can understand, it can make a big difference in their lives. Helping making finances more understandable is a great way help to people who don’t understand, for whatever reason. (And withholding judgement is an important aspect of this — we haven’t walked in their shoes, and don’t know what they are feeling. I always try to explain what I can in terms that they understand.)

My goals are to help them understand (as much as they can), and to help them feel empowered (as much as possible) in relation to their own finances. We want them to feel heard and respected. They too might be able to feel a sense of wellbeing and abundance (in their own world) if we give them a chance. (And yes, they might not be able to manage their finances on their own, however, we can still help them with their feelings and understanding, up to their own capacity at that particular time.)

Sometimes small acts of understanding and patience can make a big difference.

Practical Ways to Support Them

There are a few ways you can help someone manage their finances safely and kindly. It’s about asking (gently, kindly, and respectfully), actively listening, and assisting them when the occasion arises (consent). Ideally at the end they feel empowered, and more peaceful (rather than a bit scared, and unaware of what’s going on). Potentially they may even have feelings of abundance eg. if they have more than thought they did — or if you are able to explain and organise things so they have enough — although obviously it depends on the circumstances.

1. Offer to help with organisation – Help them sort their paperwork, create simple folders for bills, or set up automatic payments for regular expenses.

2. Explain things clearly – Financial language can be confusing. Take your time to go through letters or documents slowly, and explain what they mean in plain words.

3. Encourage independence – Whenever possible, help them stay involved in decisions. Ask questions like ‘Would you like me to show you how to do this?’ rather than just doing it for them.

4. Set up safeguards, as appropriate

Setting withdrawal limits on accounts.

Having two signatures required for large payments.

Using trusted legal tools such as an enduring power of attorney (with professional guidance).

Choosing a reputable financial adviser or support service.

Have more than one person with oversight eg. a couple of family members. Or perhaps have family meetings, to ensure a few people are across it, so it doesn't fall onto one person's shoulders, and there are checks and balances in place.

Watch for warning signs – Be alert for unusual spending, unpaid bills, or sudden changes in who’s helping them with money. These can sometimes signal that someone may be taking advantage of them. (I have come across situations like this, and it’s not good. Sometimes you need to ask questions.)

Protecting Them From Financial Abuse

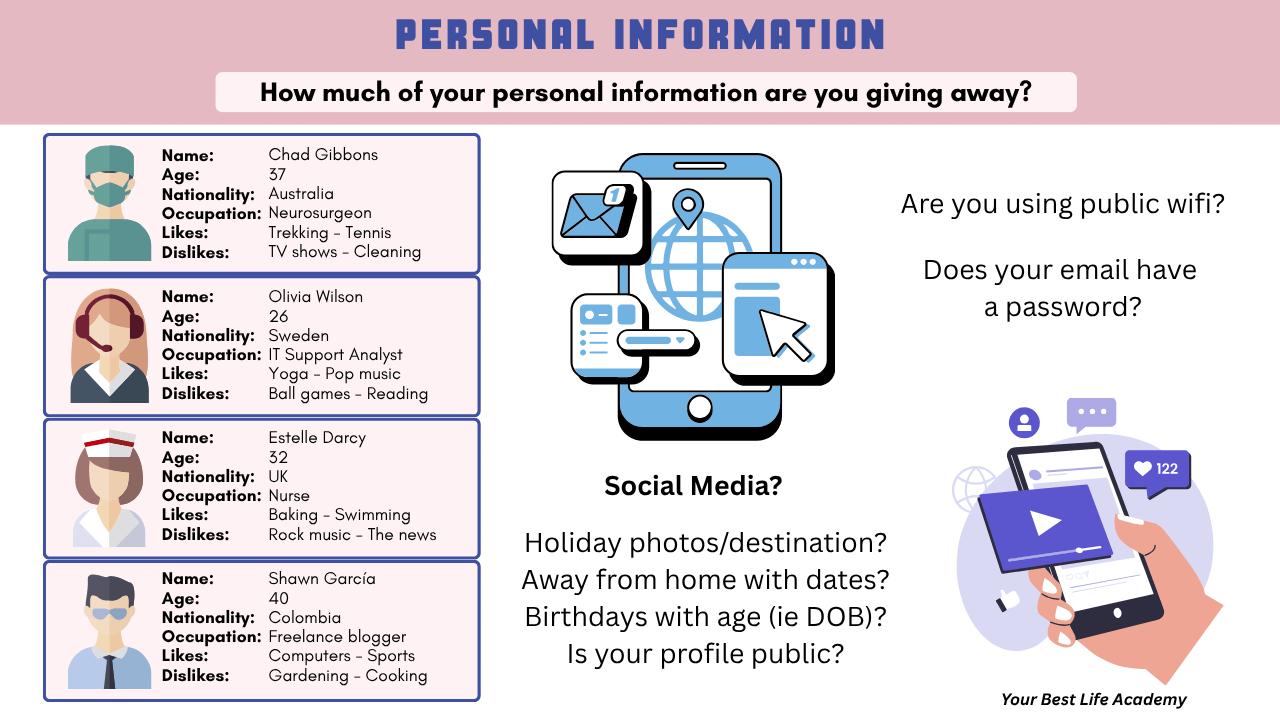

Sadly, vulnerable people can be targets for scams or exploitation — even by people they trust. Unfortunately this happens, and it’s always a sad situation. Ideally, by helping them at the right time, this can be avoided. Some ways to assist with this are outlined below.

And if it still happens (trust can be violated), call in the relevant authorities. Please don’t blindly trust people who say ‘Don’t worry about it, I’ve got it under control.’ Depending on the circumstances (eg. are you a relative? Do you suspect abuse?) ask for it to be explained to you/see the statements — and if they refuse — I would dig further. What do they have to hide? (And yes, I’ve seen this a few times — however I won’t go into details here.)

Checking in regularly, and keeping the lines of communication open. (Our free Active Listening 7-Day Challenge could be helpful here.)

Encouraging them to never give personal or financial details to strangers. (Our free download Keep Your Money Safe & Your Mind at Ease can be used to discuss this with others, helping make it an easier conversation.)

Helping them verify letters, phone calls, or emails that seem suspicious.

Reminding them that it’s always OK to say no or let me think about it.

If you suspect abuse, contact a trusted professional, such as a social worker, legal adviser, or elder support service. There are also professional bodies, such as the regulator for financial or legal advisers, or doctors, or even for homes (eg. retirement or other assisted living homes).

Balance Support With Dignity

The goal isn’t to take over someone’s finances — it’s to help them feel safe, confident, and respected. Even if they’re not able to handle everything themselves, being included in conversations helps maintain their sense of independence and dignity. And at the end of the day, everyone wants to feel loved, supported, and empowered (as much as they can be). Sometimes reassuring someone that they have enough (assuming they do) can leave them with a feeling of abundance that was missing beforehand. Shifting from a feeling of fear to abundance can be a great relief to someone struggling or vulnerable.

Final Thoughts

Helping a vulnerable person with their finances is a deeply caring act. It’s not just about money — it’s about trust, compassion, and doing the right thing. With patience and kindness, you can make a real difference in helping them feel secure and valued. And if you do feel the need to report someone, you are still doing the right thing, even if it is difficult, and/or emotional.

🙋 Frequently Asked Questions

1. What does ‘acting in someone’s best interest’ really mean?

It means doing what’s right for them, not what’s easier or better for you. It’s about making choices that support their wellbeing, wishes, and independence — always with honesty, kindness, and respect.

2. How can I tell if someone might need help with their finances?

You might notice unpaid bills, unopened mail, confusion about money, or sudden changes in their spending or mood. They may say things like ‘I don’t understand this,’ or seem anxious when talking about money. These are signs that extra support might help.

3. What’s the best way to start a conversation about money with a vulnerable person?

Start slowly, and with care. You could say something like ‘I’ve noticed this looks a bit stressful — would you like me to help you go through it?’ Always ask permission, and listen closely to their wishes. (And if you're concerned about the potential for them being taken advantage of financially, our free download Keep Your Money Safe & Your Mind at Ease can be used to discuss this with others, helping make it an easier conversation.)

4. How can I help without taking over?

Encourage them to stay involved in decisions. Offer to show them how to do things, rather than doing it all yourself. For example, sit beside them while paying bills online, or explain each step of a form before completing it together. If they would like to do it themselves, but can’t quite remember it, you could even write out the instructions for them, with screenshots to help if applicable.

5. What should I do if I think someone is being taken advantage of financially?

If you’re worried about financial abuse, try to stay calm and supportive. Gently ask questions, keep notes of what you notice, and contact a trusted professional — such as a social worker, elder helpline, or local legal aid service. You could also contact a regulator eg. financial or legal regulator in your country, or perhaps one that regulates homes (eg. retirement, or assisted living). You don’t have to handle it alone.

6. Can I become a legal decision-maker for them if needed?

In some cases, yes — but only with proper legal authority, such as an enduring power of attorney or guardianship order. It’s important to get professional legal advice before taking this step, to make sure everything is done fairly and safely. It can be a big step, with a number of processes, and potentially a large time commitment, depending on the situation.

7. What if the person doesn’t want help, even though I’m worried?

That can be hard. As long as they’re able to make decisions for themselves, they have the right to choose — even if others disagree. Keep showing care, check in often, and let them know you’re there if they change their mind. Sometimes support can take time before it can be implemented — it can be a process.

8. Are there any services that can help?

Yes, there are. Many communities offer free or low-cost support, so you might like to check some of these out in your local area.

Financial counselling services

Elder support or advocacy helplines

Legal aid or community legal centres

Trusted charities that specialise in financial wellbeing

9. How can I make sure I’m protecting them, and not crossing boundaries?

The key is communication and consent. Always involve them in every step, explain things clearly, and get their agreement before taking action. It’s also helpful to write file notes, so you have a record of each conversation. If you’re unsure, it’s always OK to pause, and seek professional advice first (eg. legal, medical, or financial). Or in a family situation, it may be appropriate to have a few family members involved.

10. What’s the most important thing to remember?

That your care, patience, and respect matter most. Helping someone with their finances isn’t just about numbers — it’s about protecting their dignity, safety, and peace of mind. Making them feel as seen, heard, and empowered as possible. And depending on the circumstances, by explaining everything to them, and helping them set up automations (if appropriate), they can feel a sense of empowerment and abundance that they didn’t have before, when they didn’t understand what was going on financially.

11. What does ‘Active Listening’ really mean, and how do I do it?

Our blog The One Skill That Deepens Every Relationship You Have discusses active listening in more detail, as well as providing hints and tips on how to do it. We also have a free Active Listening 7-Day Challenge that can help you improve your skills in that area.

📚 Additional Resources

Want more practical ideas and thought-provoking content on a regular basis? Don’t miss out on all the hints & tips that you can implement over time! Sign up for weekly input to help you uplift your life – one week at a time!

We have also created stand-alone pages in the 7 life segments with all blogs, freebies, and paid products grouped together, so you can easily find and review items of interest to you. Click on the links below to find the areas of most interest to you!

Life Purpose & Best Life - Health & Wellness - Relationships - Abundance - Personal Growth - Peace of Mind - Spirituality & Energy.

📖 References/Further Reading

https://www.healthline.com/health/mental-health/trauma-recovery

https://www.healthline.com/health/mental-health/supporting-someone-in-a-mental-health-crisis

There are also a lot of professional support services that are available. If you, or someone you love, needs one, please don't hesitate to reach out. There are so many out there (including Lifeline), so please find one that works for you. I've given an example of one below.

📝 Disclaimer

This blog shares general information only and isn’t financial or legal advice. Everyone’s situation is unique. If you or someone you care for needs guidance, please reach out to a qualified financial adviser, legal professional, or local support service.

Your Best Life Newsletter

Your Weekly Dose of Inspiration to Live Your Best Life!

✔️ Get practical tips to feel happier, healthier, and more fulfilled.

✔️ Discover easy ways to bring more joy and purpose into your life.

✔️ Be the first to know about new blogs, free resources, and special offers.

💌 Join our supportive community today — it's free!